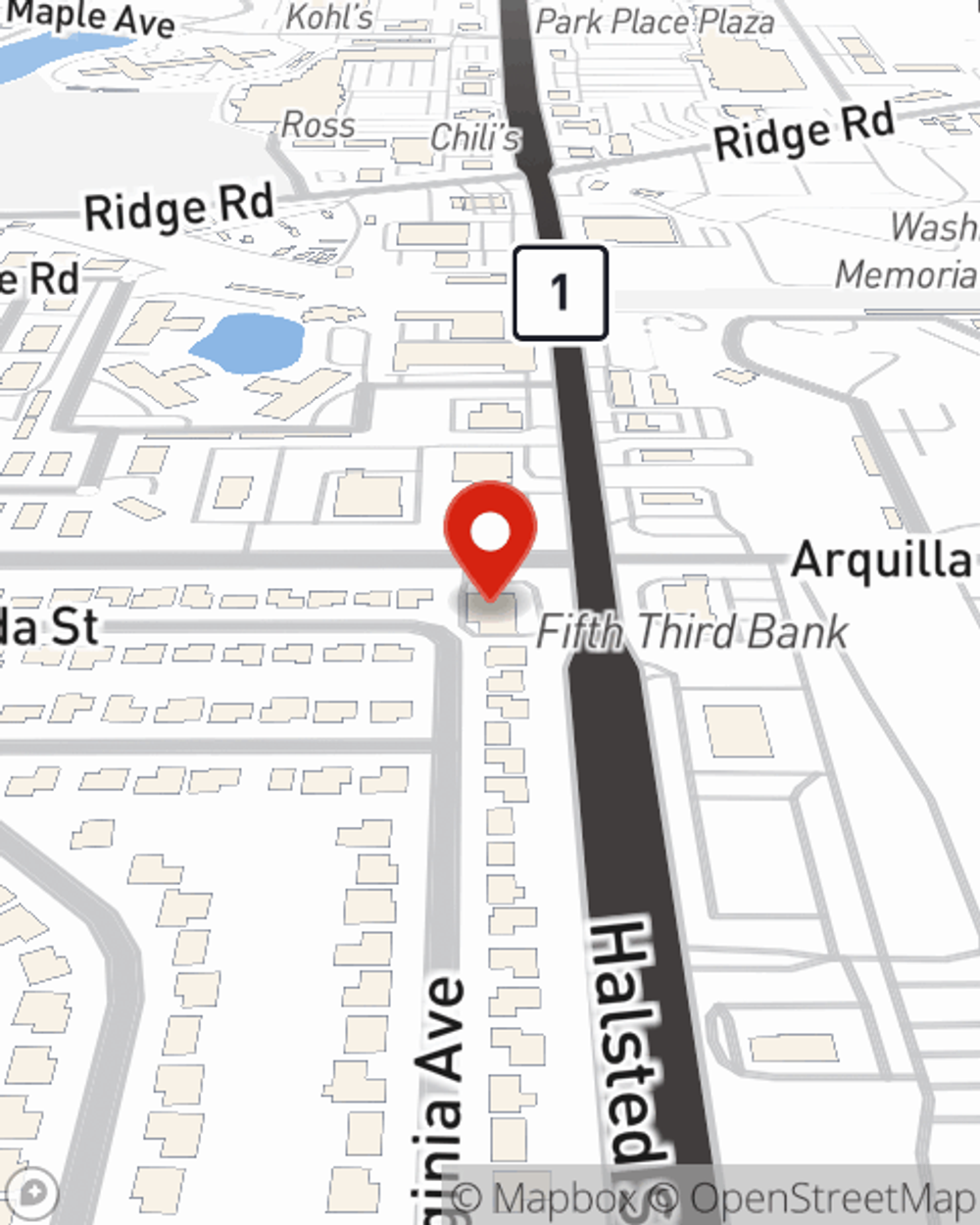

Business Insurance in and around Glenwood

One of the top small business insurance companies in Glenwood, and beyond.

Insure your business, intentionally

- All of Illinois

- Indiana

- Iowa

Your Search For Fantastic Small Business Insurance Ends Now.

Preparation is key for when an accident happens on your business's property like an employee getting hurt.

One of the top small business insurance companies in Glenwood, and beyond.

Insure your business, intentionally

Protect Your Business With State Farm

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like a surety or fidelity bond or worker's compensation for your employees, that can be formed to develop a personalized policy to fit your small business's needs. And when the unexpected does arise, agent Larry Kimbrough can also help you file your claim.

Ready to research the specific options that may be right for you and your small business? Simply contact State Farm agent Larry Kimbrough today!

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Larry Kimbrough

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.